This seemingly simple question is actually fairly complicated, even to people who work in the energy sector. We hear the question asked in a variety of different ways:

“How can you pay me to reduce my electricity?” or “Is OhmConnect a scam?”. The short answer is we can pay you by valuing your reductions of electricity in a unique way.

OhmConnect creates what is called Electricity Resources which is essentially a virtual power plant based off of your reductions. We Bid those electricity resources into various Markets, nearly 100 times per week. Each bid requests money in order to reduce electricity.

Most of the time, the electricity grid says “no, you don’t need to reduce electricity”, and in those cases, we do NOT have an OhmHour. Even if you reduced electricity during that time, we could not pay you for it. Occasionally, though, the grid says - “yes, please reduce electricity and we will pay you for it”. During those times, which are shown to you as an #OhmHour, OhmConnect has sold your reductions of electricity into the market. OhmConnect then passes those savings back to you, if you made a reduction. If you don’t make a reduction, OhmConnect is on the hook for that electricity and OhmConnect must pay for that electricity.

We are constantly improving our service in order to offer your reductions into the markets in a way that will optimize how much you could earn for reducing electricity.

If you are interested in drilling deeper into each of these sections, please read more about Energy Resources, Markets, and Bidding below.

OhmConnect is registered as a “Demand Response Provider” (DRP). DRPs build electricity resources that use a reduction of electricity as the source of generation. While most electricity resources create new electricity (like coal or solar power plants), DRPs value reductions of electricity as a replacement to new electricity. The list of DRPs in the California market (i.e. the CAISO) can be found here - OhmConnect is under “DOHMC”.

OhmConnect currently has hundreds of resources or “virtual power plants” (VPPs) which aggregate anywhere between 200-5000 users in a given resource. Those resources are created on a daily basis to reflect what a user wants, what a user provides, and where a user is located. These resources are bid separately into the market, which analyzes those resources by market conditions (primarily is driven by the location and the frequency of #OhmHours for that resource).

Generally, OhmConnect groups you and others by the consistency of your reduction, size of your reduction, and frequency that you reduce compared to others. These groupings are reflected in your Status level (diamond vs gold vs silver users), streak level (# of events you have had in a row), and other bonuses.

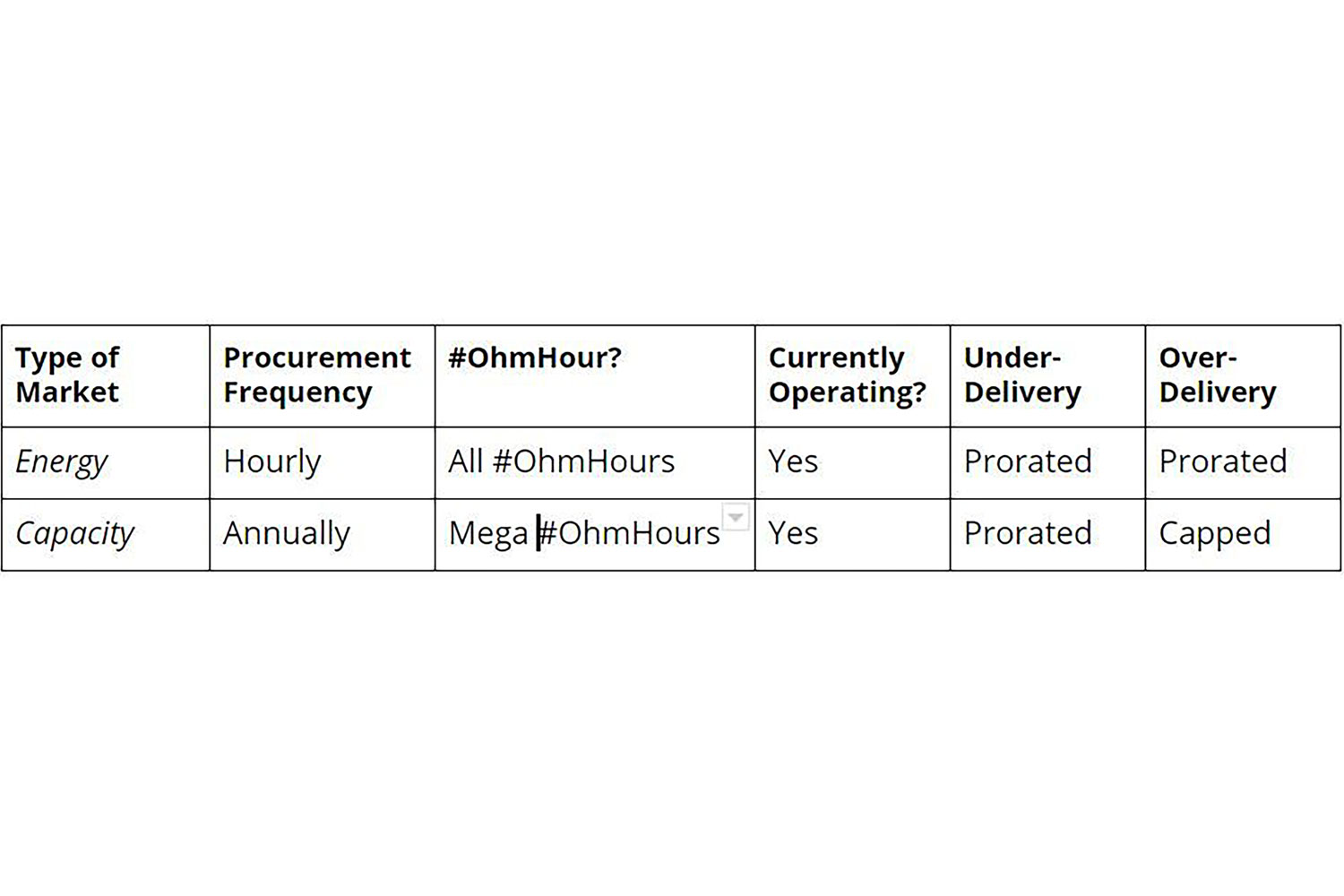

OhmConnect offers to reduce electricity in a variety of markets, including the energy and capacity market.

In most cases, OhmConnect offers into multiple markets at once. For example, OhmConnect always bids into the energy market when there is a Mega #OhmHour (and is getting paid for capacity). Comparisons across each of these markets is shown via the following table:

OhmConnect bids in the energy market on a daily basis and can bid as much energy as OhmConnect would like. OhmConnect is not limited on how much energy can be bid. If OhmConnect is accepted in the energy market, those bids are cleared and users in the resources that clear receive an #OhmHour.

For the California capacity market, OhmConnect has participated in the pilot program called the Demand Response Auction Mechanism or DRAM. DRAM is only held once a year which limits the flexibility that OhmConnect has, and each bid that is accepted will translate into a contract with a utility. Note that the DRAM is a pilot program; this program is being evaluated to see if it should become a permanent program.

Each market has nuances about the delivery of the resource in addition to the bidding schedule. For the energy market, say OhmConnect are prorated equally on under-delivery and over-delivery. For example, say OhmConnect cleared 50 MWs in the energy market. If OhmConnect delivers 40 MWs, OhmConnect will get paid for 40 MWs of delivery. If OhmConnect delivers 60 MWs, OhmConnect will get paid for 60 MWs of delivery.

Delivery requirements are not the same in the capacity market. In those cases, OhmConnect will only be paid up to the amount won in the market. OhmConnect attempts to have sufficient contracts won to account for the growth of the OhmConnect user base. For example, for all of 2018, OhmConnect has an upper bound on how much reductions we can provide for capacity. For PG&E and SCE territories, OhmConnect had more available capacity than was delivered. In other words, OhmConnect could have collected more users which would have translated into higher payments. For SDG&E territory, however, OhmConnect had more users reducing (creating more MW reductions) than it had contracts for and ended up paying out to users more than OhmConnect got paid.

We would love to hear your questions, comments, and other thoughts on learning more about how you get paid. We encourage you to reach out via on Twitter (@ohmconnect) with any questions you may have.

Explore how the transition to electrification is pivotal for achieving U.S. energy independence and security.

On this episode of Smart Energy, we're chatting about making small habit changes in the New Year, the energy grid with Elysia Vannoy, and answering a listener's question about what to do with old holiday lights.